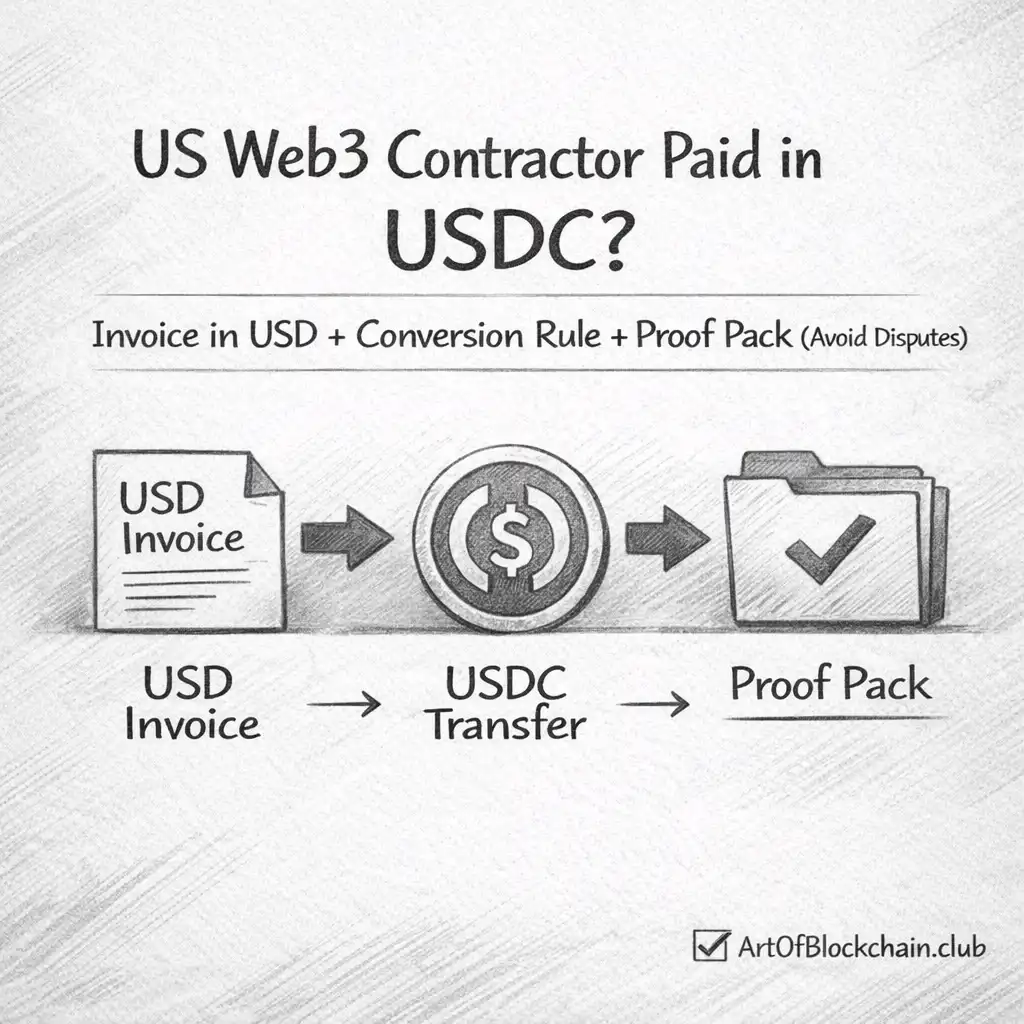

US Web3 Contractor Paid in USDC? Invoice in USD + Conversion Rule + Proof Pack (Avoid Disputes)

Not legal or tax advice. This is operational guidance for contractors to reduce disputes and keep clean records.

Getting paid in USDC for a US Web3 contract is fine — until the first dispute: “I already paid you.”

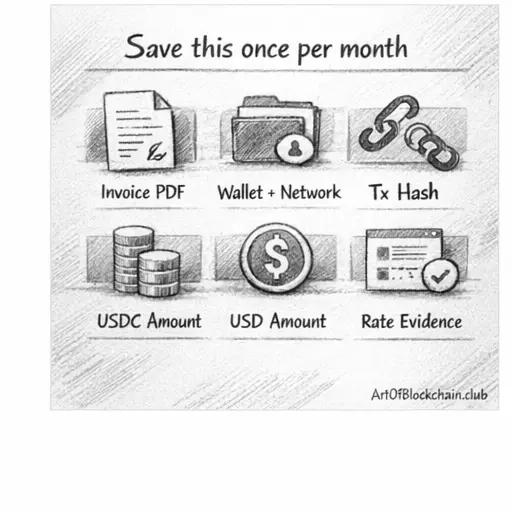

This guide shows the contractor-safe setup: invoice in USD, define one USD→USDC conversion rule (rate source + timestamp window + rounding), specify the network + who pays gas, and save a monthly proof pack (invoice PDF + wallet + tx hash + UTC timestamp + USDC amount + rate evidence).

Do this once, and you avoid rate arguments, wrong-network drama, and “proof of income” gaps later (background checks, rentals, loans, visas).

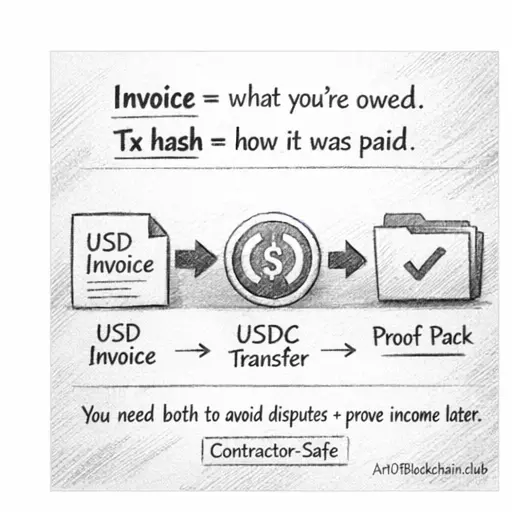

If you remember one line, make it this: Invoice = what you’re owed. Tx hash = how it was paid. You need both.

Getting paid in USDC sounds like the clean Web3-native option. No wire delays. No bank holidays. No “intermediary bank rejected it” drama. Just a transaction hash and done.

And then the first messy month happens.

The first dispute usually starts with one sentence:

“I sent you the USDC already.”

That line can be technically true and still practically wrong — because “paid” only means something if both sides agreed on the USD anchor, the conversion rule, the network/gas handling, and what counts as proof.

(If you’re comparing stablecoin pay vs token pay, keep this hub open: https://artofblockchain.club/discussion/salary-tokens-compensation-hub)

TL;DR

Keep the invoice denominated in USD even if you receive USDC.

Write one conversion rule (source + timestamp window + rounding) so “paid” has one meaning.

Specify network + gas responsibility (and what happens if they send on the wrong chain).

Save a monthly proof pack so your income is verifiable later.

Add simple fallback clauses for failed transfers and late payments.

Why this matters for US Web3 jobs (not just payments)

Web3 work histories are often contract-heavy: DAOs, short stints, protocol contributions, “no HR letter,” payments that look like wallet inflows.

Later, when a US client, verifier, landlord, or bank asks for proof of income, a tx hash alone won’t explain your work. A consistent proof pack makes your contractor income legible — and in practice, it reduces friction during verification. This is also a quiet hiring signal: you’re not just technically strong, you run your work like a professional.

If you want the broader context:

Contractor vs employee in Web3:

https://artofblockchain.club/discussion/contractor-vs-employee-in-web3-whats-better

Recruiters asking about contract-heavy profiles:

The 3 things to lock down (so “paid” has one meaning)

Most stablecoin payroll stress is not “crypto risk.” It’s a documentation risk. Treat it like a simple 3-part system:

USD anchor → what you’re owed

Conversion rule → how USD becomes USDC

Proof pack → what you save so it counts as real income later

This framing matches how real payroll systems think about stablecoin pay too: define settlement terms, define rate timing, define records.

1) Invoice in USD (even if you receive USDC)

Keep the invoice boring on purpose. It should look like something any finance person understands:

Amount due: $X USD. Due date. Payment method: USDC. Wallet + network. Invoice number.

Why USD? Because scope, milestones, and late fees usually live in fiat terms. If you anchor in USD, you avoid the “you got fewer coins than last month” argument from becoming a recurring fight.

2) Conversion rate rule (pick one, then stop arguing)

One of the most searched pain points in crypto payroll is when the exchange rate is fixed. Some platforms explicitly talk about “locking” or choosing a specific time of payroll processing to avoid volatility disputes.

Pick one approach and write it down:

Rate at time of payment

Rate at time of invoice issuance

Average window (15–60 minutes) to avoid “one candle” disputes

Then define three details clearly:

Source (which exchange/index)

Timestamp window (UTC is easiest)

Rounding (how many decimals, which direction)

Tiny example (so both sides picture the same thing):

You invoice $2,500 USD due Feb 10.

Rule: use a 1-hour average USD/USDC rate at time of payment, round to 2 decimals.

If rate = 1.0002, USDC owed = 2,500 / 1.0002 = 2,499.50 USDC (rounded).

Now “paid” is checkable, not debatable.

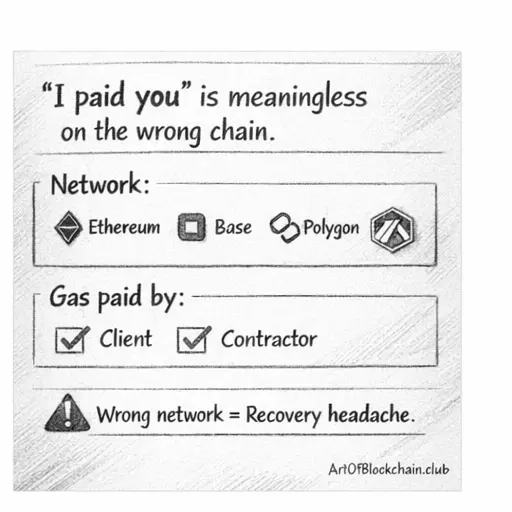

3) Network + gas: write it once to avoid drama later

Gas feels like a small number… until it isn’t. And the emotional cost is always bigger than the dollar cost.

This is where contractor relationships get weird: one side assumes gas is “part of paying,” the other assumes gas is “your wallet’s problem.” Neither side is evil — they just didn’t write it down.

Pick what’s true and document it:

Client covers gas and sends the exact USDC equivalent, or

Contractor receives a net amount and covers gas

Also specify the exact network. “I paid you” is meaningless if they sent USDC on the wrong chain. (This is an extremely common operational failure mode in crypto payments.)

If your work is tied to relocation/global work constraints, this hub helps frame real-world friction:

https://artofblockchain.club/discussion/global-relocation-work-abroad-hub

4) Proof of payment: build a monthly “proof pack”

A tx hash is evidence of a transfer, not a payslip. For records, audits, or verification, you want a small, consistent set that ties work → invoice → payment → USD value logic. People asking “what counts as proof” is a recurring theme in contractor crypto-pay threads.

Once a month, save:

Invoice PDF (invoice number)

Receiving wallet address + network

Tx hash link (block explorer)

Date/time (UTC)

USDC received

USD invoice amount

Conversion source + rate used (screenshot is fine)

Proof stack tip (for job screens + verification):

If your work history includes contracts/DAOs, you’ll get asked to prove income or continuity. Your proof pack becomes your lightweight “proof stack.” Use consistent filenames so you can export it quickly when someone asks.

Beginner-friendly warm-up (so your audience doesn’t bounce):

https://artofblockchain.club/quiz/stablecoins-are-pegged-to

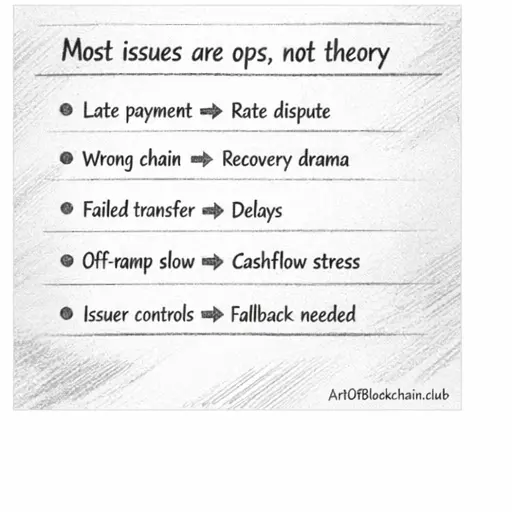

5) What can go wrong (and why it’s still fixable)

Most problems are operational, not “crypto theory”:

Late payment turns into rate disputes and cashflow pain

Wrong network becomes recovery drama

Transfers can fail due to ops mistakes or compliance checks

Off-ramping can be slow, so “stable” income feels stuck

Stablecoin-specific risk exists (issuer controls / freezes) so have a fallback rail

These are the exact categories that show up in “stablecoin payroll in practice” writeups: settlement definition, FX timing, fees, disputes, and fallbacks.

Copy-paste clauses (simple, not fancy)

Conversion rate clause

“Invoice amounts are denominated in USD. Payment will be made in USDC equivalent using the [RATE SOURCE] USD/USDC rate at [TIME RULE: time of payment / time of invoice issuance / 1-hour average window]. The rate timestamp will be recorded and shared with the transaction hash. Any rounding will be to [2/6] decimal places.”

Gas + network clause

“Payments will be made on [CHAIN/NETWORK]. Gas/network fees will be paid by [Client/Contractor]. Client will send [gross/net] USDC such that the contractor receives the full USD invoice equivalent.”

Fallback clause

“If USDC transfer fails, is delayed beyond [X days], or is not possible due to compliance/operational reasons, client will pay via [bank transfer / alternate stablecoin / alternate rail] within [X days].”

What this reveals about a Web3 team (useful in interviews)

Stablecoin pay isn’t just a payment method — it’s a maturity signal.

A team that can calmly answer network, conversion timestamp, and proof format usually has better habits elsewhere too (clear scopes, predictable cadence, fewer surprise delays). This aligns with how compliance-focused payroll guidance frames stablecoin pay: consent, documentation, and clear settlement practices.

Ask:

“Which network do you pay on, and can you reimburse gas?”

“What conversion rate source + timestamp do you use?”

“Do you support a fallback rail if a transfer fails?”

“Can you share a sample invoice + payment proof format?”

Related AOB discussions

Web3 hiring risks + compensation:

https://artofblockchain.club/discussion/web3-hiring-risks-compensation

How do you guys handle stablecoin pay:

https://artofblockchain.club/discussion/getting-paid-in-stablecoins-how-do-you-guys-handle-this

Contractor vs employee in Web3:

https://artofblockchain.club/discussion/contractor-vs-employee-in-web3-whats-better

FAQs

1) Should I invoice in USD if I’m paid in USDC?

Yes. USD keeps scope, milestones, and late fees unambiguous. USDC is the payment rail, not the obligation anchor.

2) What conversion rate should we use for USD→USDC?

Pick one rule (invoice time, payment time, or a short average window) and define source + timestamp window + rounding. Payroll FAQs often highlight “locking” or fixing the rate timing to reduce disputes.

3) Who pays gas fees when paying in USDC?

Either side can — but it must be written, and the network must be specified. Confusion here is a common operational failure mode.

4) What proof should I keep for USDC income?

Invoice PDF + wallet + network + tx hash + UTC timestamp + USDC amount + rate evidence. Keep it monthly so it’s exportable later.

5) Is stablecoin payroll allowed in the US?

In general, US guidance focuses on consent and tax/recordkeeping obligations; employers and payroll counsel treat stablecoin payroll as feasible with compliance and documentation handled properly.

6) What can go wrong even with USDC?

Late payments (rate disputes), wrong chain, failed transfers, off-ramp delays, and stablecoin issuer controls—so write fallbacks.

CTA

If you’re applying for US Web3 roles and your profile includes contracts/DAOs, the difference between “interesting” and “shortlisted” is often your proof stack, not more buzzwords. I do CV + proof-stack reviews so your experience reads like delivered work (and can be verified cleanly). Reply “CV”.

If you’re a hiring team paying contractors in stablecoins, add payment rail + network + conversion rule + proof expectations to the JD. It filters serious candidates fast and reduces ops churn later. I do a JD Risk Score + rewrite, and can feature the role here:

https://artofblockchain.club/discussion/hiring-managers-recruiters-hub-hiring-signals-interview-expectations

For overall job navigation:

https://artofblockchain.club/discussion/job-search-web3-career-navigation-hub